The wealth management industry, valued at $1.25 trillion in 2020, is undergoing a transformative phase, projected to reach $3.43 trillion by 2030. This remarkable growth, at a CAGR of 10.7% from 2021 to 2030, signifies the evolving dynamics of the sector. In this article, we delve into the key trends, challenges, and innovations shaping the future of wealth management, drawing insights from industry leaders and market analysis.

The Current State of Wealth Management

Market Valuation and Growth Prospects

The global wealth management market, which was valued at $1.25 trillion in 2020, is forecasted to grow significantly, reaching $3.43 trillion by 2030. This growth represents a Compound Annual Growth Rate (CAGR) of 10.7% from 2021 to 2030. This robust expansion is a testament to the resilience and adaptability of the wealth management industry, especially in the face of global economic challenges like the COVID-19 pandemic.

Table: Projected Growth of the Wealth Management Market (2021-2030)

| Year | Market Value (Trillion USD) | CAGR |

| 2020 | 1.25 | |

| 2030 | 3.43 | 10.7% |

Regional Market Insights

- North America: Continues to lead the market, driven by the rising adoption of wealth management services and increasing awareness of its benefits.

- Asia Pacific: Expected to grow at a high CAGR due to technological advancements and an inclination toward investing in alternative assets.

Market Segmentation

The wealth management market is segmented based on:

- Type of Asset: Including equity, fixed income, alternative assets, etc.

- Advisory Mode: Covering human advisory, robo advisory, and hybrid advisory.

- Type of Wealth Manager: Such as private banks, investment managers, and full-service wealth managers.

- Enterprise Size: Including large enterprises and small and medium enterprises.

- Client Type: Ranging from mass affluent to high net worth individuals (HNWIs), pension funds, insurance companies, and sovereign wealth funds.

Key Players in the Market

Prominent players in the market include JPMorgan Chase & Co., Wells Fargo & Company, Bank of America Corporation, UBS Group AG, Morgan Stanley, Goldman Sachs Group, Inc, Credit Suisse Group AG, HSBC Holdings plc, and several others.

This data indicates a significant growth trajectory for the wealth management market, driven by technological advancements, changing client preferences, and the increasing complexity of financial markets. The role of wealth management in providing comprehensive financial solutions to individuals, particularly in emerging economies, is expected to be a key driver of this growth.

Emerging Trends in Wealth Management

Integration of Banking and Investing

The blurring lines between traditional banking and wealth management are evident as national banks and fintechs collaborate to offer integrated services. This integration aims to provide a seamless experience for clients, combining banking and investment services under one umbrella.

Personalized Investing

Customization is becoming increasingly important in wealth management. Personalized, tax-efficient managed accounts are becoming more accessible, catering to the specific needs of high net worth and ultra-high net worth segments. Technologies like direct indexing and fractional share trading are revolutionizing this space, making it possible to create tailored portfolios at lower investment thresholds.

Rise of Digital Assets

The digital asset class, including cryptocurrencies, has seen exponential growth. From a market capitalization of $100 billion in 2019 to over $2.5 trillion, these assets have captured the interest of a wide range of investors. The challenge for wealth managers lies in navigating the regulatory ambiguity and infrastructure requirements of these new asset classes.

List: Key Trends in Wealth Management

- Integration of Banking and Investing

- Personalized Investing

- Rise of Digital Assets

Innovations Driving the Market

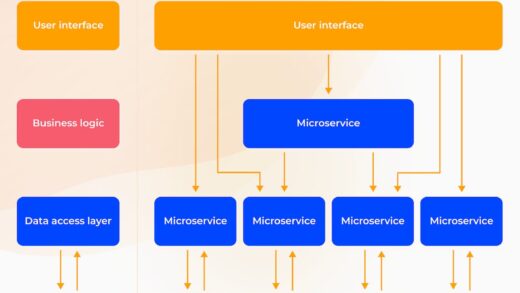

Adoption of Financial Technology

The emergence of FinTechs in the wealth management sector has been a game-changer. These technology-driven firms have introduced innovative solutions that are reshaping how wealth management services are delivered. From AI and big data analytics to IoT applications, the digital transformation in this sector is profound.

Democratization of Private Markets

Private market investments, once the preserve of institutional investors, are now becoming accessible to individual portfolios. This shift is driven by investor appetite for alternative investments and supported by fintech infrastructure providers. The potential growth in assets allocated to private markets is substantial, with projections of an increase from 2% in 2020 to 3-5% by 2025.

Family Office Services for Ultra-High Net Worth Families

Family office services have become increasingly important for ultra-high net worth families. These services provide comprehensive wealth management, including investment management, estate planning, philanthropic endeavors, and family governance. Family offices offer a personalized approach to managing significant wealth, ensuring that financial strategies are aligned with the family’s values and long-term objectives. The rise of family offices reflects the growing complexity of managing vast wealth, where a tailored, holistic approach to financial and asset management is crucial.

The Road Ahead: Strategic Shifts and Opportunities

New Business Models

Wealth management firms are exploring innovative business models to stay ahead in a competitive market. These models focus on adapting to evolving client needs and regulatory landscapes. The integration of new technologies and product offerings is central to these emerging business models.

Client-Centric Approaches

The shift towards a more client-centric approach is evident in the wealth management industry. Firms are prioritizing personalized services, focusing on building long-term relationships with clients, and adapting to their evolving financial needs and preferences.

Global Expansion and Market Dynamics

Developing economies present significant growth opportunities for wealth management firms. The increasing number of high net worth individuals in emerging markets like China, India, and Southeast Asia is a lucrative avenue for expansion. Firms are strategically positioning themselves to tap into these emerging markets, offering a range of wealth management product lines tailored to the unique needs of these regions.

Conclusion

The wealth management industry stands at a pivotal point, with unprecedented growth potential and dynamic changes underway. As the industry evolves, wealth management firms must adapt